This normally happens when the bank needs to take extra steps verifying the transaction. There may be times when clearing a check takes longer than usual. As such, bank holidays typically don’t count towards a check’s clearing time. Do checks clear on bank holidays?Īs the name implies, banks and other financial institutions are normally closed on bank holidays. You may wish to consult with your local bank for their policies on this. This is at their sole discretion and may not always apply.

Some financial institutions may advertise extended business hours or days. That means a check deposited Friday night after business hours will be treated as if it were deposited Monday morning (if it isn’t a holiday). Do checks clear on Saturdays?īusiness days don’t typically include weekends or holidays. Deposits made past that time will usually be part of the next business day's transactions. Business days, on the other hand, refer to days when the bank is open for business - weekends and bank holidays are not considered business days.Ī business day typically ends at the same time the bank's business hours do, and some institutions may even have an earlier cutoff time for check deposits. Calendar days generally denote any 24-hour period from midnight to midnight. Keep in mind the distinction between business days and calendar days. Checks where both accounts are held by the same institution.Checks from federal and other government agencies.

#Bank of america checkbook full

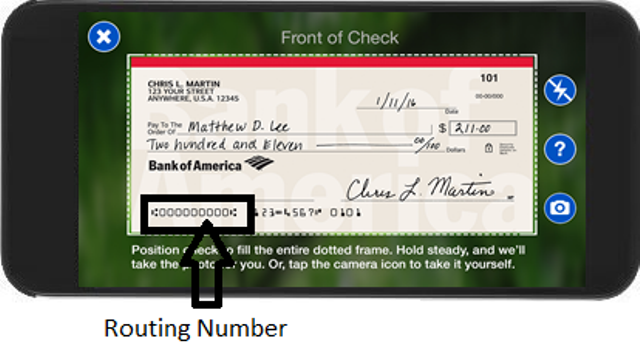

Procedures for check verification typically vary from bank to bank.Ĭertain types of checks are designed to clear faster, often being available in full by the next business day. Note that certain checks may take additional time, particularly if it’s an international transfer as those may take longer to verify. Understandably, you may be wondering, “How long does it take for a check to clear?” When do checks clear?īy law, banks are required to make at least the first $225 of a personal check deposit available for use by the next business day.

However, payments from checks aren’t normally available immediately. Still, there are plenty of occasions when people may use physical paper checks to send and receive payments. The digital age has transformed banking as we know it.

0 kommentar(er)

0 kommentar(er)